Setting Up an Integrated Facilities Management (IFM) Company in Singapore

- Roger Pay

- Aug 1, 2025

- 17 min read

Updated: Aug 3, 2025

Setting Up IFM Company Singapore

Integrated Facilities Management (IFM)

Integrated Facilities Management (IFM) is a comprehensive and strategic approach to managing an organization's physical assets and infrastructure. Instead of handling various facility services (like maintenance, cleaning, security, and energy management) through multiple contracts and vendors, IFM consolidates them under a single, unified system and management team.

Here's a deeper dive into what IFM entails:

Core Concept:

At its heart, IFM is about integration and centralization. It brings together traditionally siloed facility services and processes, often under a single outsourced provider, to create a more cohesive, efficient, and cost-effective operational model.

Key Components of IFM:

IFM encompasses both "hard" and "soft" facilities management services:

Hard FM Services: These deal with the physical aspects of a building and its systems:

Mechanical & Electrical (M&E) Maintenance: HVAC systems, plumbing, electrical systems, lighting, fire safety systems.

Building Maintenance: Structural integrity, roof, facade, interior finishes, general repairs.

Asset Management: Lifecycle management of equipment and infrastructure, predictive and preventive maintenance.

Energy Management: Optimizing energy consumption, sustainability initiatives, utility management.

Soft FM Services: These focus on people-centric services and the operational environment:

Cleaning & Housekeeping: Daily cleaning, specialized cleaning, waste management.

Security Services: Access control, surveillance, guarding, emergency response.

Landscaping & Grounds Maintenance: Upkeep of outdoor areas.

Pest Control: Prevention and eradication of pests.

Helpdesk/Call Center Services: A single point of contact for all facility-related requests.

Space Management & Optimization: Efficient use of space, move management, reconfigurations.

Catering & Vending Services (sometimes included): Managing food and beverage provisions.

Workplace Experience: Creating a comfortable, safe, and productive environment for occupants.

How IFM Works:

Single Point of Contact: Instead of managing numerous vendors, the client interacts with one IFM provider. This simplifies communication, contract management, and overall oversight.

Centralized Systems: IFM providers often leverage advanced technology like:

Computerized Maintenance Management Systems (CMMS): For managing work orders, preventive maintenance schedules, and asset tracking.

Building Management Systems (BMS): For monitoring and controlling building systems like HVAC, lighting, and security.

Integrated Workplace Management Systems (IWMS): Comprehensive platforms that combine various FM functions.

Internet of Things (IoT) Sensors: For real-time data collection on energy usage, occupancy, and equipment performance.

Data Analytics: To gain insights from facility data, optimize operations, and identify cost-saving opportunities.

Strategic Alignment: IFM aims to align facility operations with the organization's broader business goals. It moves beyond just "fixing things" to proactively optimizing the built environment to support productivity, sustainability, and cost efficiency.

Outcome-Based Approach: A growing trend in IFM is shifting from input-based (e.g., hours worked) to outcome-based contracts. This means the IFM provider is incentivized to achieve specific results (e.g., reduced energy consumption, improved uptime, higher occupant satisfaction) rather than simply performing a list of tasks.

Benefits of Integrated Facilities Management:

Cost Reduction:

Economies of Scale: Consolidating services often leads to better negotiation power with suppliers and reduced administrative overhead.

Reduced Redundancies: Eliminating overlapping services and optimizing resource allocation.

Predictive Maintenance: Using data to anticipate equipment failures, preventing costly breakdowns and extending asset life.

Increased Efficiency and Productivity:

Streamlined Operations: Simplified workflows and processes with a single management team.

Faster Issue Resolution: A centralized helpdesk and coordinated response to incidents.

Improved Communication: Clearer lines of communication between the client and the service provider.

Enhanced Service Quality and Consistency:

Standardized Processes: Ensures consistent service delivery across all facilities.

Performance Monitoring: Easier to track Key Performance Indicators (KPIs) and measure overall performance.

Specialized Expertise: Access to a broad range of skilled professionals within the IFM provider's team.

Strategic Focus:

Core Business Focus: Allows organizations to concentrate on their primary activities, delegating facility management to experts.

Data-Driven Decisions: Leverages technology and data analytics for informed strategic planning and continuous improvement.

Better Risk Management: Proactive identification and mitigation of operational and safety risks.

Sustainability and Compliance:

Energy Optimization: Implementing energy-efficient practices and technologies.

Waste Reduction: Streamlined waste management programs.

Regulatory Compliance: Ensuring adherence to health, safety, and environmental regulations.

Improved Workplace Experience: A well-maintained, safe, and comfortable environment contributes to employee satisfaction, health, and productivity.

IFM vs. Traditional Facilities Management:

Feature | Traditional Facilities Management (FM) | Integrated Facilities Management (IFM) |

Service Provision | Multiple vendors for different services (e.g., separate cleaning, security, maintenance contractors). | Single provider manages and delivers a comprehensive suite of services under one contract. |

Contract Management | Numerous contracts, often with different terms and conditions. | One master contract, simplifying administration and negotiation. |

Coordination | High internal coordination required to manage disparate services. | Centralized coordination by the IFM provider, reducing client burden. |

Approach | Often reactive; focuses on individual tasks and immediate needs. | Strategic and proactive; focuses on overall outcomes, long-term planning, and optimization. |

Technology Usage | May use disparate systems or manual processes for each service. | Leverages integrated technology platforms (CMMS, BMS, IoT) for holistic data management and automation. |

Cost Control | Potentially less transparent costs, harder to identify redundancies. | Greater cost control through economies of scale, streamlined processes, and data analytics. |

Accountability | Fragmented accountability across multiple vendors. | Single point of accountability with the IFM provider. |

Scalability | Can be challenging to scale services across multiple locations. | Easier to scale and standardize services across diverse portfolios. |

In Singapore, the move towards IFM is strongly encouraged by authorities like the BCA, particularly with the emphasis on "Smart FM" and outcome-based contracts, recognizing its benefits in enhancing productivity, sustainability, and overall building performance.

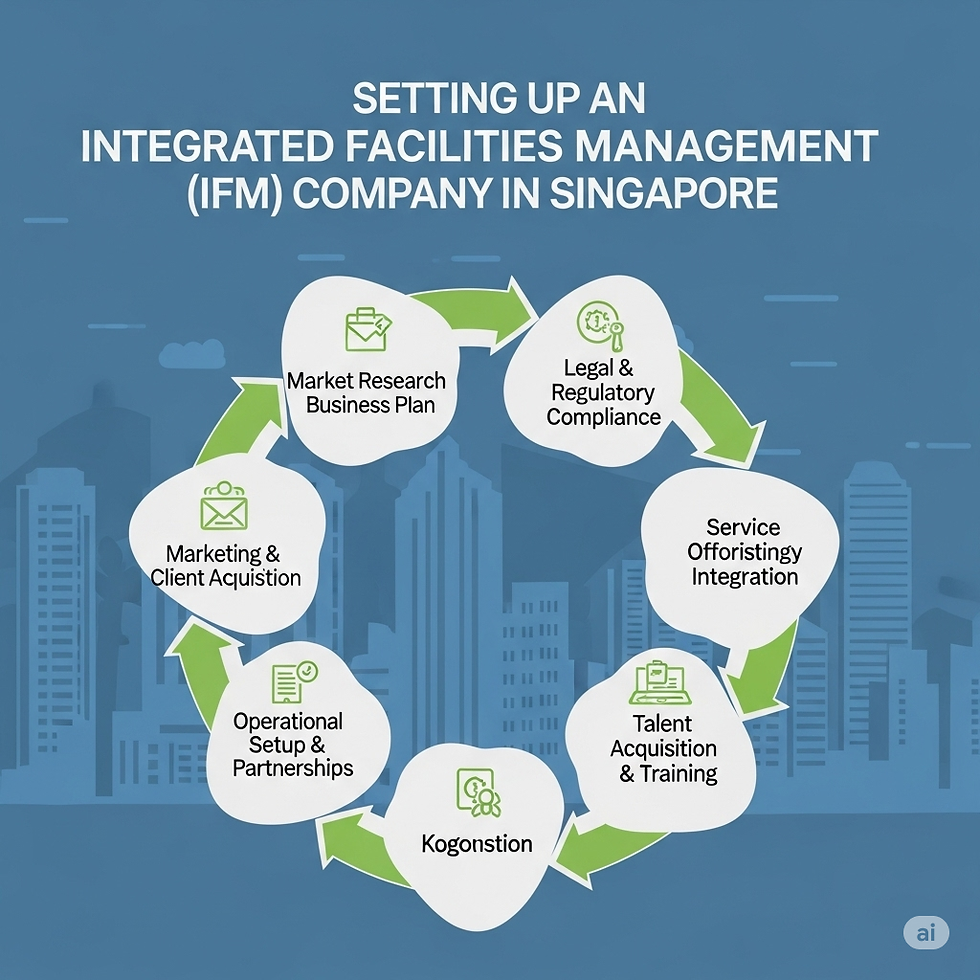

Setting Up an Integrated Facilities Management (IFM) Company in Singapore

Setting up an Integrated Facilities Management (IFM) company in Singapore involves several key steps, focusing on both general business registration and specific industry regulations. Here's a breakdown of what you'll need to consider:

Company Name: Choose a unique and suitable name for your IFM company.

Company Type: Decide on your business structure (e.g., Private Limited Company, Sole Proprietorship, Partnership). A Private Limited Company is typically recommended for its limited liability and professional image.

Directors and Shareholders: Appoint at least one resident director (Singapore Citizen, Permanent Resident, or EntrePass holder) and at least one shareholder.

Company Secretary: Appoint a qualified company secretary within six months of incorporation.

Registered Address: Secure a physical registered address in Singapore.

Paid-Up Capital: A minimum of S$1 for paid-up capital is required for private limited companies.

Registration Process: Register your company with the Accounting and Corporate Regulatory Authority (ACRA) via their online portal, BizFile+.

2. Facilities Management (FM) Registry with BCA:

For companies looking to provide FM services, especially for public sector projects in Singapore, registration with the Building and Construction Authority (BCA) under the FM01 Workhead is crucial. This is specifically for Integrated Facilities Management (IFM) and/or Managing Agent (MA) services.

Eligibility Requirements: BCA sets out specific requirements for each grade (M1, M2, M3, M4) within the FM01 Workhead. These typically include:

Financial Capability: Meeting minimum paid-up capital and net worth requirements. Higher grades require higher financial thresholds and annual submission of audited accounts.

Track Record: A proven track record of successfully completing relevant FM projects within the past five years. For M1 grade, at least one IFM contract is required.

Personnel Qualifications: Employing qualified personnel with relevant experience and technical qualifications. This includes individuals with degrees or diplomas in Facilities Management, Civil/Structural, Mechanical/Electrical/Electronic Engineering, Architecture, Building, or relevant accreditations from SIFMA.

Company Certifications: Holding relevant certifications like BizSAFE Level 3/Star (Occupational Health and Safety Management) or ISO 45001 is advantageous and often required for higher grades.

FMC Accreditation: For M1 and M2 grades, obtaining the Facilities Management Company (FMC) Accreditation (at least "Certified" tier) from the Singapore International Facility Management Association (SIFMA) is mandatory. Higher tiers (Gold, GoldPlus) demonstrate higher standards.

Application Process: Review the "Registration Requirements for Facilities Management Workhead (FM)" document on the BCA website for detailed criteria and application procedures.

3. Other Relevant Licenses and Accreditations:

Depending on the specific services your IFM company will offer, you may need additional licenses or accreditations:

NEA Licenses: If your services include pest control, you will need a Vector Control Operator Certificate issued by the National Environment Agency (NEA). If cleaning services are a core offering, aiming for the "Clean Mark Gold Award" under the Enhanced Clean Mark Accreditation Scheme by NEA is beneficial.

WSHC Certifications: BizSAFE certifications (Level 3, Star) from the Workplace Safety and Health Council (WSHC) are important for demonstrating commitment to workplace safety.

Professional Certifications: Encourage your staff to obtain relevant professional certifications like the Facility Management Professional (FMP) from the International Facility Management Association (IFMA) or various modular certificates in Smart Facilities Management from BCA Academy.

4. Financial Considerations and Funding:

The cost of setting up an IFM company will vary based on its scale and the services offered. Key costs include:

Company Registration Fees: ACRA fees for incorporation.

Office Rental: Cost of securing office space.

Staffing Costs: Salaries for qualified FM professionals, technical staff, and administrative personnel.

Equipment and Technology: Investment in tools, maintenance equipment, and potentially smart FM solutions like Computerised Maintenance Management Systems (CMMS) and Building Management Systems (BMS).

Certifications and Accreditations: Fees for obtaining required industry certifications.

Insurance: Relevant business insurance policies.

Potential Grants and Support:

Integrated Facilities Management (IFM) and Aggregated Facilities Management (AFM) Grant: The BCA offers grants to encourage the adoption of outcome-based IFM and AFM contracts and Type 3 Smart FM solutions. This grant can help cover design, technology, and training costs. To qualify, your company must be registered under BCA's FM01 Workhead and accredited with at least a 'Gold' tier rating under SIFMA's CFMC accreditation scheme.

Startup SG Founder and Equity: These programs by Enterprise Singapore offer funding and mentorship for new startups with innovative business ideas.

Business Improvement Fund (BIF): This grant supports companies in driving technology innovation, adopting new solutions, and redesigning business models to improve productivity.

Market Readiness Assistance (MRA) Grant: If you plan for international expansion, this grant can help with market research and business development trips.

5. Building Your Team and Expertise:

Qualified Personnel: Recruit experienced and certified Facilities Managers, M&E engineers, technicians, and other relevant specialists.

Smart FM Capabilities: With the increasing demand for smart buildings, developing expertise in Smart FM is crucial. This involves leveraging IoT sensors, data analytics, predictive maintenance, and integrated digital platforms.

Training and Development: Invest in continuous training for your staff to keep up with industry advancements and new technologies, such as those offered by BCA Academy and other polytechnics in Singapore (e.g., Specialist Diploma in Smart Facilities Management, Certificate in Integrated Facilities Management).

Key Considerations for IFM:

Integrated Approach: IFM refers to the provision of at least two distinct FM services (e.g., building maintenance, M&E maintenance, security, cleaning, landscaping, pest control) under one contract.

Outcome-Based Contracts: The industry is moving towards outcome-based IFM and AFM contracts that focus on results rather than just activities.

Digitalization: Embrace digital solutions like CMMS, BMS, and data analytics to optimize operations, enhance productivity, and provide value-added services.

Sustainability: Integrate sustainable practices and green building principles into your FM services.

Setting up an IFM company in Singapore requires careful planning and adherence to regulations. Engaging with relevant authorities like ACRA and BCA, and seeking advice from business consultants specializing in Singapore company formation, can streamline the process.

Fees

Setting up and running an Integrated Facilities Management (IFM) company in Singapore involves various fees, from initial registration to ongoing compliance and operational costs. Here's a breakdown:

I. Initial Setup Fees (Company Incorporation with ACRA)

Company Name Application Fee: S$15

Company Registration Fee: S$300

Total ACRA Administrative Fees: S$315 (for a Private Limited Company)

Optional - Special UEN (Unique Entity Number): If you want a preferred, easy-to-remember UEN, this can cost S$1,000 (Tier 2) or S$3,000 (Tier 1). This is entirely optional.

Corporate Secretarial Services: Bestar offers incorporation packages ranging from S$500 to S$1,500+. These include:

ACRA company registration

Provision of a company secretary (mandatory in Singapore) for the first year.

Registered office address for the first year.

Drafting of company constitution.

Assistance with opening a corporate bank account.

Nominee Director Service (if required for foreign owners): If you don't have a local resident director, you'll need to appoint a nominee director. This service can cost around S$1,800 to S$2,000 per annum.

II. Industry-Specific Licenses and Accreditations

BCA FM01 Workhead Registration (Crucial for IFM): The Building and Construction Authority (BCA) does not explicitly publish a specific application fee for the FM01 workhead. However, there are significant financial and resource requirements that effectively act as "costs" for meeting the eligibility criteria. These include:

Paid-up Capital & Net Worth: These vary significantly by grade (M1, M2, M3, M4). For example:

M1 requires S$2 million paid-up capital and S$40 million in relevant project track record.

M2 requires S$1.5 million paid-up capital and S$20 million in track record.

M3 requires S$500,000 paid-up capital and S$5 million in track record.

M4 requires S$50,000 paid-up capital and S$100,000 in track record.

Personnel Qualifications: Costs associated with hiring and retaining qualified staff (e.g., those with diplomas/degrees in Facilities Management or related engineering fields, or SIFMA accreditations).

Certifications: Costs for obtaining BizSAFE (Level 3/Star) or ISO 45001.

FMC Accreditation (from SIFMA): For M1 and M2 grades, you must obtain at least the "Certified" tier under SIFMA's Facilities Management Company (FMC) Accreditation scheme. SIFMA typically charges fees for this accreditation process, which would involve an application fee, assessment fee, and annual renewal fee. (Specific figures are not readily published publicly and would likely require direct inquiry with SIFMA).

NEA Cleaning Business License (if offering cleaning services):

Application/License Fee: S$130 (payable upon approval). This license is valid for 2 years.

Paid-Up Capital Requirement: This is not a fee, but a requirement:

Class 1 License: Minimum S$250,000 paid-up capital.

Class 2 License: Minimum S$25,000 paid-up capital.

Progressive Wage Model (PWM) Compliance: You will incur costs related to ensuring your cleaning workforce meets the PWM requirements for wages and training. This could involve training fees and potential adjustments to salary structures. Advisory services for PWM compliance can range from S500−S3,000+ for one-off setup.

NEA Vector Control Operator Certificate (if offering pest control services):

Vector Control Technician Licence (for individuals): S$28.00 (Full)/ S$16.50 (Provisional).

Company License: There's a mandatory NEA license for pest control companies. Specific fees for the company license are not explicitly listed publicly but would be part of the application process. You'll also incur costs for ensuring your technicians are trained and certified (e.g., Joint ITE-NEA Certificate in Pest Management).

BizSAFE Certification (Workplace Safety and Health Council - WSHC): While there might not be a direct "application fee" for BizSAFE levels, there are costs associated with:

Consultancy fees to help you achieve the required safety management systems.

Audit fees by WSHC-approved auditors for BizSAFE Star.

Training fees for employees (e.g., for bizSAFE Level 3 requires a risk management course).

III. Ongoing Annual Compliance and Operational Costs

Annual ACRA Filing Fee: S$60 (for filing annual returns).

Annual Corporate Secretarial Services: S280toS900+ per annum (if using a firm).

Annual Nominee Director Service: S1,800toS2,000+ per annum (if required).

Registered Office Address: S110toS420 per annum (if using a virtual office provider).

Accounting and Tax Filing Services:

Book-keeping: S250toS2,500 per month (depending on volume).

Compilation of financial statements: From S$400 onwards.

Tax filing services: S350toS500 per filing.

Statutory audit services: From S$3,000 per audit (if not exempted as a small company).

Software and Technology:

CMMS/BMS/IWMS licenses/subscriptions: These can range from hundreds to thousands of dollars per month/year depending on features and scale.

IoT sensor infrastructure and data analytics platforms.

Staffing Costs: Salaries, CPF contributions, insurance, training, and benefits for your FM professionals, technicians, and administrative staff. This will be your largest ongoing cost.

Equipment & Tools: Purchase and maintenance of specialized FM equipment.

Insurance: Public liability insurance, professional indemnity insurance, and other relevant business insurance policies.

Training and Professional Development: Investing in continuous training for your staff (e.g., BCA Academy courses, SIFMA accreditations, industry workshops).

Rent/Utilities: For your office space and operational facilities.

Overall Startup Cost (Highly Variable):

Considering all the factors, a basic setup for an IFM company in Singapore (excluding the high capital requirements for higher BCA grades) could realistically start from:

Minimum (basic setup, no nominee director, small scale): S$2,000 − S$5,000 initially (covering ACRA, basic secretarial, and initial license fees).

More Realistic (with professional services, some initial operational costs): S$10,000 − S$30,000+ for initial setup, before considering substantial operational costs, staff salaries, and the significant capital requirements for higher BCA FM01 grades.

The most substantial "fees" or investments for an IFM company will be in:

Meeting the BCA FM01 workhead financial and track record requirements.

Hiring and retaining qualified and experienced personnel.

Investing in appropriate technology and smart FM solutions.

It's highly recommended to consult with a corporate service provider in Singapore to get a tailored quote for company incorporation and ongoing compliance, and to directly check with BCA, NEA, and SIFMA for the most current and specific fees related to their respective licenses and accreditations.

Professional Fees

When setting up an Integrated Facilities Management (IFM) company in Singapore, "professional fees" refer to the costs incurred for engaging Bestar to ensure proper incorporation, compliance, and operational efficiency. These fees are distinct from government levies or direct operational expenses.

Here's a breakdown of common professional fees you'll encounter:

I. Company Incorporation and Secretarial Services:

These are bundled services offered by Bestar.

Incorporation Service Fee: This is the fee charged by Bestar to handle the entire company registration process with ACRA on your behalf.

Range: S$500 to S$1,500+ (one-off fee). Many packages include the first year of corporate secretarial services.

Corporate Secretarial Services (Annual): This is a mandatory ongoing service. A qualified company secretary ensures your company complies with the Singapore Companies Act and other regulations.

Services include: Maintaining statutory registers, preparing and filing annual returns with ACRA, organizing Annual General Meetings (AGMs), processing changes in company particulars (directors, address, etc.).

Range: S$280 to S$900+ per annum. More complex companies or those requiring more ad-hoc support may pay higher.

Registered Office Address Service (Annual): If you don't have a physical office yet, you'll need a registered address. Bestar offers this.

Range: S$110 to S$420 per annum.

Nominee Director Service (Annual): If all your directors are foreign residents, you must appoint a local resident nominee director. This service includes the director acting as a statutory requirement and includes due diligence.

Range: S$800 to S$5,000+ per annum. A deposit (S$4,000) also is required.

II. Accounting and Tax Services:

Engaging professional accountants and tax agents is crucial for financial compliance.

Bookkeeping Services (Monthly/Quarterly/Annually): For recording financial transactions. Fees depend heavily on transaction volume and complexity.

Range: S$90 to S$2,000+ per month (or equivalent annual/quarterly rates).

Compilation of Unaudited Financial Statements: Required annually for most small to medium-sized companies.

Range: From S$500 for active companies, potentially lower for dormant ones.

Corporate Tax Filing Services (Form C/C-S): Preparation and submission of your company's income tax returns to IRAS.

Range: From S$400 to S$1,500+, depending on complexity.

Goods and Services Tax (GST) Filing: If your company is GST-registered.

Range: From S$150 per quarter.

XBRL Conversion of Financial Statements: Required for certain companies filing with ACRA.

Range: S$200 to S$700 per annum.

Payroll Services: For managing employee salaries, CPF contributions, and IR8A submissions.

Range: S$15 to S$30 per employee per month, or a base rate plus per-employee fee.

Audit Fees (if required): If your company exceeds certain thresholds, it will require a statutory audit.

Range: From S$3,000 upwards annually, depending on company size and transaction volume.

III. Industry-Specific Consultancy & Accreditation Support:

Given the nature of IFM, you'll likely engage Bestar for specific industry compliance.

BCA FM01 Workhead Application Advisory: Bestar can guide you in preparing the necessary documentation, proving financial capability, tracking record, and meeting personnel requirements. This can save significant time and ensure a successful application.

Range: Varies widely based on the grade you're applying for and the complexity of your current situation. Could be a few thousand dollars for advisory.

SIFMA FMC Accreditation Consultancy: For M1 and M2 grades, FMC accreditation is mandatory. Bestar can assist in preparing for the accreditation audit, developing necessary policies, and ensuring your company meets SIFMA's standards.

Range: Expect fees for initial assessment, process documentation, and potentially ongoing retainer for compliance maintenance.

NEA Cleaning Business License Application Support: Bestar can help navigate the requirements, including the Progressive Wage Model (PWM) compliance plan and workforce training.

Range: S$500 to S$2,000+ for one-off setup support, plus ongoing advisory for PWM compliance (S$50 − S$200+ per employee/month or S$500 − S$2,000+ monthly retainer for smaller businesses).

BizSAFE Certification Consultancy & Audit: To achieve BizSAFE levels (especially Level 3 and Star), you'll likely engage WSHC-approved consultants for risk management plan development and external auditors.

Consultancy: Varies by scope, but can range from a few thousand dollars.

Audit Fees: Charged by approved auditors for BizSAFE Star.

Training Fees: For staff training (e.g., bizSAFE Level 1 workshop, Level 2 risk management course). For example, BizSAFE Level 1 workshop can be around S130perpax,andBizSAFELevel2coursearoundS390 per pax.

Professional Fees: For drafting specific contracts, service agreements, or intellectual property protection.

Hourly Rates: Can range from S$200 to S$800+ per hour for Bestar, or project-based fees.

Human Resources (HR) Consultancy: For developing HR policies, employee contracts, compensation structures, and ensuring compliance with labor laws.

Range: Varies by scope, from a few hundred for basic templates to several thousands for comprehensive HR system setup.

IV. Other Advisory/Consultancy Fees:

Business Plan Development: If you need a comprehensive business plan for funding or strategic direction.

Market Research & Feasibility Studies: To understand the IFM market in Singapore.

Technology Consultation: For selecting and implementing smart FM solutions (CMMS, BMS, IoT).

Important Considerations:

Bundled Packages: Bestar offers attractive bundled packages for incorporation and initial compliance services, which can be more cost-effective than engaging individual services.

Complexity Drives Cost: The more complex your company structure, the higher your transaction volume, the more specialized services you offer, and the higher the BCA grade you aim for, the higher your professional fees will be.

Retainer vs. Ad-Hoc: Some services (like corporate secretarial or ongoing accounting) are on an annual retainer, while others (like specific professional advice or a one-off license application support) are charged on an ad-hoc or project basis.

Request detailed quotes and service agreements from Bestar to understand what is included in our fees before committing.

How Bestar can Help

Engaging professionals is not just a convenience when setting up an Integrated Facilities Management (IFM) company in Singapore; it's often a strategic necessity for ensuring compliance, efficiency, and long-term success. The regulatory landscape in Singapore is robust, and the IFM sector has specific requirements that necessitate expert guidance.

Here's how Bestar can help your IFM company:

Company Incorporation: We handle the entire registration process with ACRA, from name reservation to drafting the company constitution, ensuring all documents are accurate and submitted correctly. This prevents delays and potential rejections.

Company Secretary: As a mandatory requirement in Singapore, Bestar can provide a qualified company secretary who ensures ongoing compliance with the Companies Act, maintains statutory registers, files annual returns, and advises on corporate governance.

Registered Office Address: We can provide a legal registered address in Singapore, which is essential for incorporation, especially if you don't have a physical office yet.

Nominee Director: If you are a foreign entrepreneur without a local resident director, Bestar can provide this service, fulfilling a key regulatory requirement.

Bank Account Opening Assistance: We can guide you through the process of opening a corporate bank account in Singapore, often connecting you with suitable banks.

General Business Advisory: Bestar offers broad business advisory, helping you understand the business environment, initial legal structures, and general compliance obligations.

Bookkeeping: We establish and maintain accurate financial records, which is crucial for monitoring performance, managing cash flow, and ensuring compliance.

Financial Statement Preparation: We prepare your company's annual financial statements in accordance with Singapore Financial Reporting Standards (SFRS).

Tax Compliance: We compute your corporate income tax, prepare and file tax returns (Form C/C-S) with IRAS, and advise on available tax incentives and exemptions relevant to new businesses or specific to the IFM sector (e.g., potential grants). We also handle GST registration and filing if applicable.

Payroll Management: We can manage your payroll, ensuring accurate salary calculations, CPF contributions, and timely submission of IR8A forms.

Audit (if applicable): If your company grows beyond a certain size, it will require a statutory audit. Bestar can conduct this independently.

Financial Planning: We can assist with budgeting, forecasting, and financial strategy to ensure the long-term financial health and sustainability of your IFM operations.

Contract Drafting and Review: We are essential for drafting and reviewing complex IFM service contracts, sub-contracts with vendors, client agreements, employee contracts, and non-disclosure agreements (NDAs). This protects your company's interests and minimizes legal risks.

Compliance with Industry Regulations: Bestar can provide expert advice on specific regulations pertinent to the IFM sector, ensuring your operations comply with all relevant laws beyond just company law (e.g., building maintenance regulations, workplace safety laws).

Intellectual Property (IP) Protection: If your IFM company develops proprietary smart FM solutions or technology, Bestar can help with patent, trademark, and copyright registration and enforcement.

4. Industry-Specific Consultants (e.g., BCA, SIFMA, WSHC, NEA Specialists):

BCA FM01 Workhead Application: This is perhaps one of the most critical areas where Bestar can help. We possess in-depth knowledge of BCA's complex requirements for the FM01 workhead (grades M1 to M4), including:

Financial Proof: Guiding you on how to demonstrate sufficient paid-up capital and net worth.

Track Record: Assisting in compiling and presenting your project track record effectively to meet BCA's stringent criteria.

Personnel Qualifications: Advising on the required technical qualifications and experience of your key personnel, and helping you identify suitable hires or training programs.

Documentation: Ensuring all required documents are accurately prepared and submitted to BCA's eBACS system.

SIFMA Facilities Management Company (FMC) Accreditation: For higher BCA FM01 grades (M1, M2), SIFMA accreditation is mandatory. Bestar can prepare your company for the accreditation audit, help develop necessary quality management systems, policies, and procedures to meet SIFMA's "Certified," "Gold," or "GoldPlus" tiers.

NEA Cleaning Business License / Pest Control Operator Certification: If your IFM scope includes these services, Bestar can navigate the specific licensing requirements, including the Progressive Wage Model (PWM) for cleaning and the necessary training/certification for pest control technicians.

BizSAFE Certification (WSHC): Bestar can guide your company through the process of achieving BizSAFE Level 3 or Star, which demonstrates your commitment to workplace safety and health and is often a prerequisite for government tenders. This involves developing risk management plans and undergoing audits.

Smart FM / Technology Adoption: Bestar can advise on integrating smart FM technologies (CMMS, BMS, IoT), helping you select the right solutions, plan for implementation, and optimize their use to enhance operational efficiency.

HR Policy Development: Creating comprehensive HR policies, employee handbooks, and standard operating procedures.

Recruitment and Talent Acquisition: Helping to identify, attract, and onboard qualified facilities management professionals and technicians.

Compensation and Benefits: Designing competitive salary structures and benefits packages to attract and retain talent in the FM industry.

Training and Development: Advising on continuous professional development programs for your FM staff to keep their skills current and compliant with industry standards.

Compliance with Employment Laws: Ensuring your company adheres to Singapore's employment laws, including the Employment Act, Central Provident Fund (CPF) regulations, and foreign worker quotas.

In summary, engaging professionals provides several critical advantages:

Ensures Compliance: Navigating Singapore's strict regulatory framework without expert help can lead to errors, delays, penalties, and even legal issues.

Saves Time and Resources: Bestar handles complex administrative and regulatory tasks, allowing your core team to focus on business development and service delivery.

Mitigates Risks: Expertise helps identify and mitigate financial, legal, operational, and safety risks.

Provides Expertise and Best Practices: Access to specialized knowledge and industry best practices that might not be available in-house.

Enhances Credibility: Proper incorporation and adherence to industry standards, often guided by professionals, build trust with clients and partners.

Facilitates Growth: A strong foundation laid with professional support enables smoother scaling and sustainable growth for your IFM company.

While professional fees are an investment, they often lead to significant cost savings and better outcomes in the long run by preventing costly mistakes and optimizing operations.

Comments